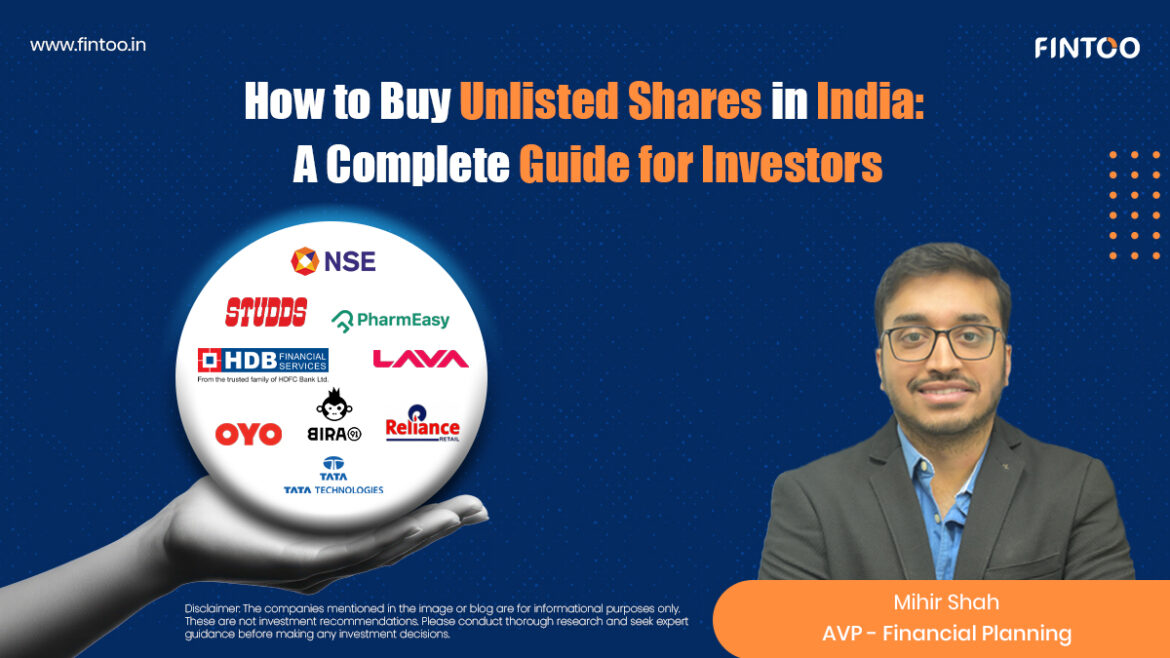

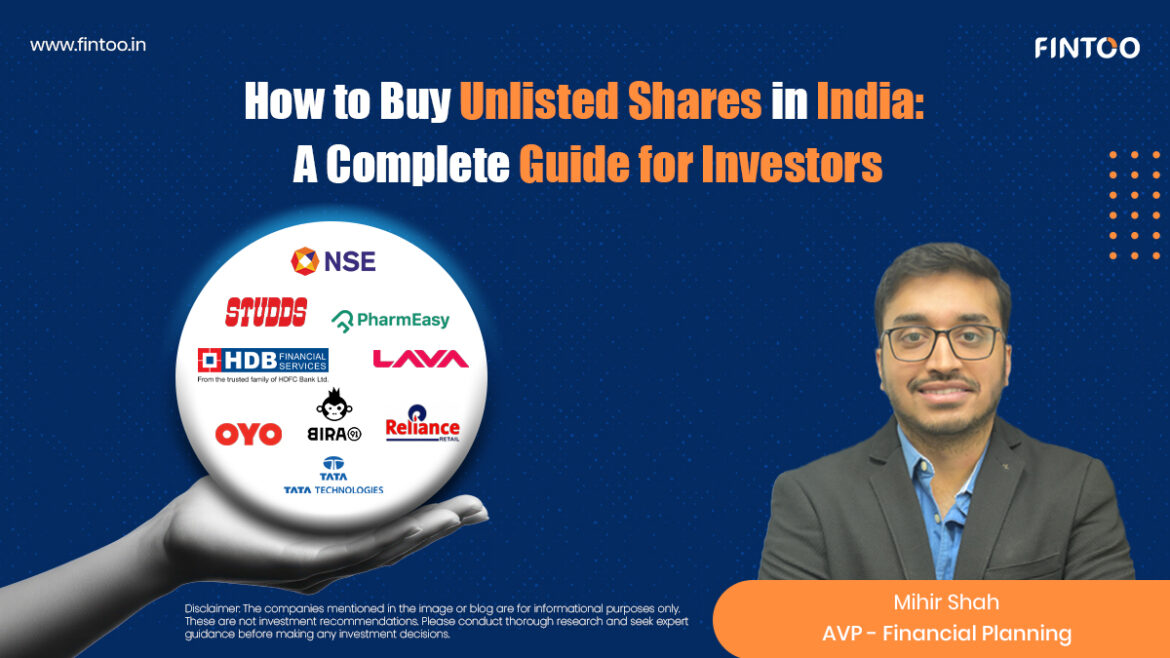

How to Buy Unlisted Shares in India: A Complete Guide

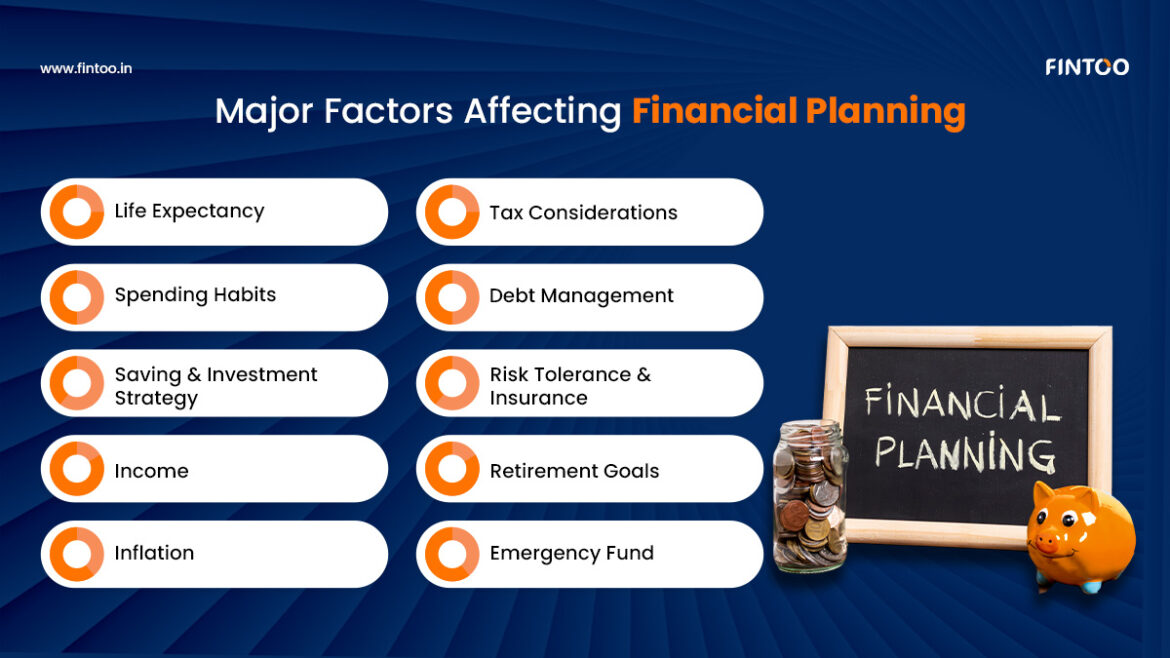

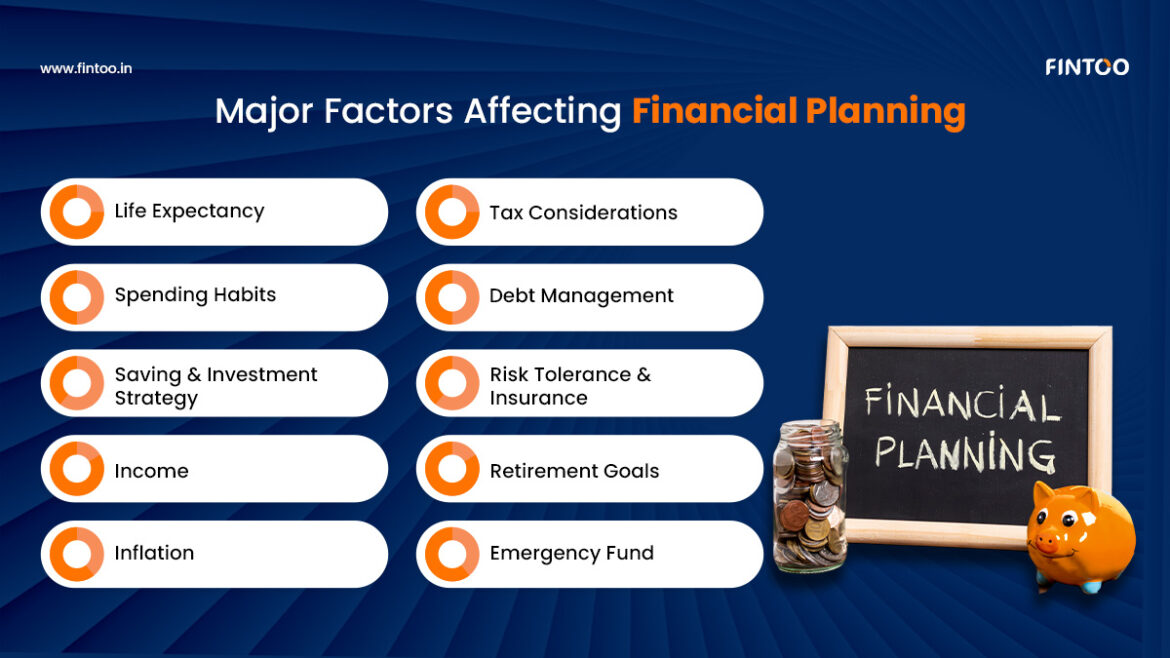

10 Major Factors Affecting Financial Planning 2025

Union Budget 2024: Tax Benefits Extended, Slabs Unchanged, Capex Boosted – Exploring Key Announcements

Budget 2024 Date, Time and Expectations

Why Is Financial Advisory Important?

What Is Asset Allocation And Why Is It Important?

How To Start Investing? A Beginner’s Guide

What Are The National Highway Authority Of India Bonds?

How to use the Fintoo Chatbot for managing your money?